do you pay taxes on inheritance in indiana

Indiana inheritance tax was eliminated as of January 1 2013. Indiana repealed the inheritance tax in 2013.

If the total value of the deceaseds estate including all of their money property and things exceeds the Inheritance Tax threshold of 325000 and the deceaseds estate is unable or unwilling to pay you may be liable to pay Inheritance Tax on their behalf.

. Although some Indiana residents will have to pay federal estate taxes Indiana does not have its own inheritance or estate taxes. There is no inheritance tax in Indiana either. However other states inheritance laws may apply to you if.

You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012. Unlike the federal estate tax the beneficiary of the property is responsible for paying the tax not the estate. Repeal of Inheritance Tax PL.

They are New Jersey Maryland Pennsylvania Nebraska Iowa and Kentucky. The state where you live is irrelevant. The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1.

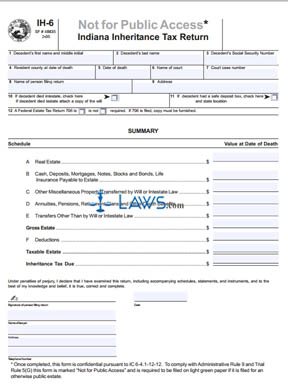

Below we detail how the estate of Indiana will handle your estate if theres a valid will as well as who is entitled to your property if you have an invalid will or none at all. Estate tax is paid by the estate and before any inheritances are passed to beneficiaries. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed.

Do you have to pay taxes on inheritance in Indiana. As of 2020 only six states impose an inheritance tax. Whereas the estate of the deceased is liable for the estate tax beneficiaries pay the inheritance tax.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed and no tax has to be paid. Contact an Indianapolis Estate Planning Attorney. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person.

The tax is not applicable if the decedent passed away after December 31st of 2012. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012.

We had an inheritance tax in Indiana but it was repealed. At the present time there are only six states that still have inheritance taxes. There is also a tax called the inheritance tax.

As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property and assets at death. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. Indiana Inheritance and Gift Tax.

You wont have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income but the type of property you inherit might come with some built-in income tax consequences. How Much Is Inheritance Tax. Any property you possessed as joint tenants is immediately passed on to you.

If you have to pay inheritance tax your tax rates depend on how closely related you were to the decedent and the total fair market value of your inheritance. However as of 2021 only six states impose an inheritance tax. Sandra would be responsible for paying the tax.

Even if you do end up owing some money in taxes on the sale of the home I hope you and your brother can still view this as a. 205 2013 Indianas inheritance tax was repealed. In 2021 federal estate tax generally applies to assets over 117 million.

Brother should discuss the best course of action with an accountant to determine which strategy would best reduce your tax bill. Unrelated individuals usually pay the highest rates. Although the State of Indiana did once impose an inheritance tax the tax was repealed for deaths that occurred after 2012.

Inheritance tax applies to assets after they are passed on to a persons heirs. For more information please join us for an upcoming FREE seminar. Both inheritance and estate taxes are called death taxes.

The deceased person lived in a state that collects a state inheritance tax or owned bequeathed property located there and the heir is in a class that isnt exempt from paying the tax. You should certainly have a comprehensive understanding. There is no federal inheritance tax but there is a federal estate tax.

You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012. 1 How much can you inherit without paying taxes. How much tax do you pay when you sell an inherited house.

In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of Checking Account Form IH-19 are required for those dying after Dec. In addition no Consents to Transfer Form IH-. Indiana repealed the inheritance tax in 2013.

Indiana repealed the inheritance tax in 2013. For individuals dying after December 31 2012. For example if you inherit a traditional IRA or a 401k youll have to include all distributions you take out of the account in your.

An inheritance tax is a state tax that you pay when you receive money or property from the estate of a deceased person. No tax has to be paid. An heirs inheritance will be subject to a state inheritance tax only if two conditions are met.

Should States Tax Inheritances Scioto Analysis

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

Indiana Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Dor Indiana Extends The Individual Filing And Payment Deadline

Free Form Ih 6 Indiana Inheritance Tax Return Free Legal Forms Laws Com

State Estate And Inheritance Taxes Itep

Introduction To Estate Planning Indiana Journal Of Global Legal

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Here S Which States Collect Zero Estate Or Inheritance Taxes

Indiana Estate Tax Everything You Need To Know Smartasset

State Estate And Inheritance Taxes Itep

State Estate And Inheritance Taxes Itep

Indiana Estate Tax Everything You Need To Know Smartasset